All company directors in Australia are required to have a specific identifier number. This is a unique identifier given by the Australian Business Registry Services (ABRS). Closing date for applications 30 November 2022. If you need assistance please contact our office.

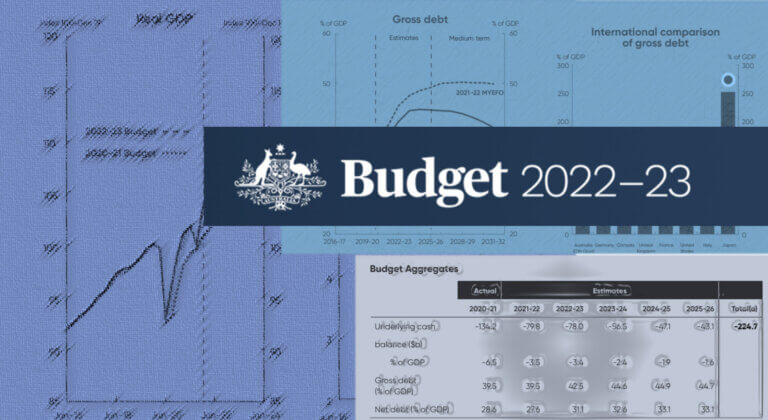

With seven months before the 2023-24 Budget released in May 2023, this Budget is a shuffling of the deck not a new set of cards. As expected, this year’s second Federal Budget had a strong focus on families, education, health and aged care, energy and affordable housing, not businesses.

With seven months before the 2023-24 Budget released in May 2023, this Budget is a shuffling of the deck not a new set of cards. As expected, this year’s second Federal Budget had a strong focus on families, education, health and aged care, energy and affordable housing, not businesses. Grants for payments for Farmers, Primary Producers and Small Businesses

Grants for payments for Farmers, Primary Producers and Small Businesses